Company Report

-

FMDQ Exchange welcomes Union Bank of Nigeria CP programme

FMDQ Securities Exchange Limited has once again demonstrated operational excellence in the processing and approval of the registration of the Union Bank of Nigeria Plc’s N100 billion Commercial Paper (CP) Programme, on the Exchange platform in September 2022. The registration will bring the total number of securities admitted on FMDQ Exchange to 110 with a total market value of N3.36…

Read More » -

FMDQ Exchange admits LFZC’s N25bn 20-Year infrastructure bond

FMDQ Securities Exchange Limited has listed t LFZC PLC’s N25 billion Series 2 Fixed Rate Bond under its N50 billion Bond Issuance Programme on the Exchange’s Platform. This issuance by LFZC Funding SPV, has broken a record as the corporate bond issued with the longest tenor – 20 years – in the Nigerian debt markets. LFZC is a special-purpose vehicle…

Read More » -

Awori to takeover from Ayeyemi as Ecobank Group CEO

Ecobank Transnational Incorporated (ETI), the parent company of the Ecobank Group on Monday announced that the current Group Chief Executive Officer, Ade Ayeyemi, will retire after he attains the age of 60, in accordance with ETI policy. The Board of Directors has selected Jeremy Awori to succeed Ayeyemi as Group Chief Executive Officer. The relevant effective dates will be communicated…

Read More » -

Illegal haulage: Dangote patrol team arrests, hand over errant drivers to authorities

In a renewed effort to rid the Dangote Group of unscrupulous drivers who engaged in illegal haulage activities and others who constituted themselves into menace to other road users, the company’s drivers’ Patrol team, has made several arrests of drivers, and handed them over to relevant authorities. Dangote’s management, it would be recalled, recently solicited the help of members of…

Read More » -

Tax Evasion: Customers stranded as Kogi govt. seals First Bank branches over N411m

The Kogi State Government on Monday sealed-off all First Bank Nigeria PLC branches operating in the State over failure to liquidate its outstanding tax liabilities of over N411million to the State coffers. According to a report by kadecommunicationng, many of the bank customers were stranded due to the closure of the bank branches across the State by the State Government.…

Read More » -

International Breweries holds responsible beverage service training in key Lagos LGAs

International Breweries Plc, a member of AB InBev, the largest beer maker in the world with over 500 brands, has taken its Responsible Beverage Service (RBS) training campaign to key local government areas (LGA) in Lagos State. The Responsible Beverage Service (RBS) is an intervention by International Breweries to address the harmful use of alcohol through various channels and features…

Read More » -

FMDQ Exchange approves N30bn CP programme to boost agriculture

FMDQ Securities Exchange Limited (FMDQ Exchange) on Tuesday said it has approved the registration of the Johnvents Industries Limited’s N30billion Commercial Paper (CP) Programme on its platform. Johnvents Industries Limited is a wholly indigenous-owned agribusiness that provides modern information and communication tools, macro-loans, and farm inputs, such as seedlings and fertilisers, to support farmers and finance their businesses in Nigeria,…

Read More » -

CBN imposes N84.11m sanction on GTCO, Fidelity Bank

The Central Bank of Nigeria (CBN) has imposed N84.11million sanction on Guaranty Trust Holding Company Plc (GTCO) and Fidelity Bank Plc over market infractions. Extracts from half year ended June 30, 2022 showed that CBN imposed N42.86million penalty on Fidelity Bank for contravening its cryptocurrency policy. Fidelity Bank had received a sanction of N14.28 million for cryptocurrency infractions, according to…

Read More » -

Zenith Bank, GTCO, 2 others declare N40.58bn interim dividend in H1 2022

Four banks, Stanbic IBTC Holdings Plc, Zenith Bank Plc, Guaranty Trust Holding Company Limited (GTCO) and Fidelity Bank Plc have declared N40.58billion interim dividend payout to shareholders in half year (H1) ended June 30, 2022 results and accounts. Fidelity Bank joined other elite banks in interim dividend payout, on the backdrop of impressive corporate earnings. Westernpost gathered that Stanbic IBTC…

Read More » -

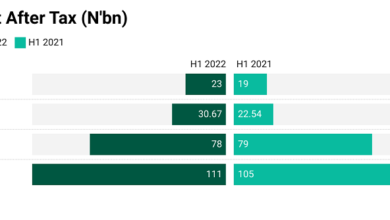

BREAKING: Hike in income tax expense erodes GTCO’s profit by 2.3%

Guaranty Trust Holding Company Plc (GTCO) on Monday reported 88.3 per cent increase in income tax expense to N25.69billion in its half year (H1) ended June 30, 2022 leading to 2.3 per cent decline in profit after tax in the period. The lender on the Nigerian Exchange Limited (NGX) reported N77.56billion profit in H1 2022 from N79.4billion in H1 2022,…

Read More »